PDF to Word Converter - FAQs

In the FAQ section of our PDF to Word Converter PDF program you will find a question and answer catalog that we will constantly expand with the time and if necessary to new topics.

To unfold, please click on the following panels:

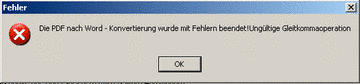

This error occurs very rarely, but, in this case, please alter the conversion mode of the PDF to Word converter from the standard setting ‘automatic conversion mode (default)’ to a user-defined mode!

It would be best to use the user-defined conversion with tabs here. After altering the conversion mode, please try to convert the PDF to Word again.

If necessary, you should alter further settings options on the ‘advanced settings’ tab if the problem occurs again. You can try to further specify the extraction options to exclude the incompatible content of the PDF document from the conversion during the PDF to Word transfer.

This error occurs when PDF2Word Converter automatically tries to open Word, OpenOffice or LibreOffice following successful conversion, despite the respective program already being open.

The opened text processing software may even block the creation of the converted Word file. If this error occurs, you should ensure that Word etc. has not been launched. Then try again. This should rectify the problem.

In this case, switch the conversion mode to “Reformat document (reflow)” and try again.

When the layout has not been transferred cleanly to Word, the error is generally not due to 7-PDF2Word. The problem usually lies with the PDF file itself, i.e. it contains errors, is defective etc.

To solve this problem, we have added an automatic repair and optimisation routine to our PDF printer software, 7-PDF Printer, which automatically repairs PDF documents when printing again to PDF (via Acrobat Reader or other PDF viewers).

The newly created file can then usually be converted with 7-PDF2Word without losing the layout.

Presumably, her original PDF file contained only image information. So pictures that were saved in a PDF. A good example of this would be a PDF generated by a fax machine or scanner. These devices only "capture" the contents of a printed paper and save it as a PDF file, but without actually saving the content in platform-independent, vectorized digital information in the form of a "real" PDF file. And exactly this content you get in Word. So an image that was in the PDF document. Since Word is not a graphics application, you can not edit this image data.

You may NOT be able to produce editable Word documents if one of the following conditions applies:

- The PDF was created by a scanner

- The PDF is a form

* A scan to PDF simply embedds an image into the PDF. We would say, it's a PDF bluff package - however, you do not what the content from the PDF, rather from the image! So the method is not PDF2Word, rather OCR2Word.

If you have further questions about the program, please contact our free eMail support. Otherwise, we wish you much pleasure with our PDF to Word Converter!