7-PDF Invoice Extractor (KI Service) 🤖

📢 From now on: Licenses for 7-PDF Attach Extract and Remove + API Token are only available upon request and subject to availability.

🔄 Effortlessly convert PDF invoices into ZUGFeRD PDFs (e-invoices)

With the 7-PDF Invoice Extractor (an AI-powered online service), you convert PDF invoices from Word, Excel, Access, legacy ERP systems, or DMS into valid ZUGFeRD e-invoices (DIN EN 16931) without additional complexity – optionally directly via our print workflow from almost any application. A prerequisite for reliable and standards-compliant conversion is that the layout and text flow are machine-readable and formally correct according to DIN EN 16931. Once your invoice data meets these formal requirements, the conversion proceeds compliantly and reliably.

With the 7-PDF Invoice Extractor (an AI-powered online service), you convert PDF invoices from Word, Excel, Access, legacy ERP systems, or DMS into valid ZUGFeRD e-invoices (DIN EN 16931) without additional complexity – optionally directly via our print workflow from almost any application. A prerequisite for reliable and standards-compliant conversion is that the layout and text flow are machine-readable and formally correct according to DIN EN 16931. Once your invoice data meets these formal requirements, the conversion proceeds compliantly and reliably.

Our AI service runs on our own server infrastructure in Germany and automatically detects, among others:

- Supplier & customer (incl. VAT ID, IBAN, BIC)

- Line items (quantity, SKU, price, VAT, line totals)

- Invoice totals (net, tax, gross)

- Surcharges, shipping costs, discounts

- Reverse charge scenarios

- Output as ZUGFeRD-compliant XML

Get started quickly — fair licensing:

1) Desktop: After the free trial, you need an API token for the AI service and a lifetime license for 7-PDF Attach Extract and Remove. If you use the optional print workflow, we also recommend 7-PDF Printer Professional (lifetime).

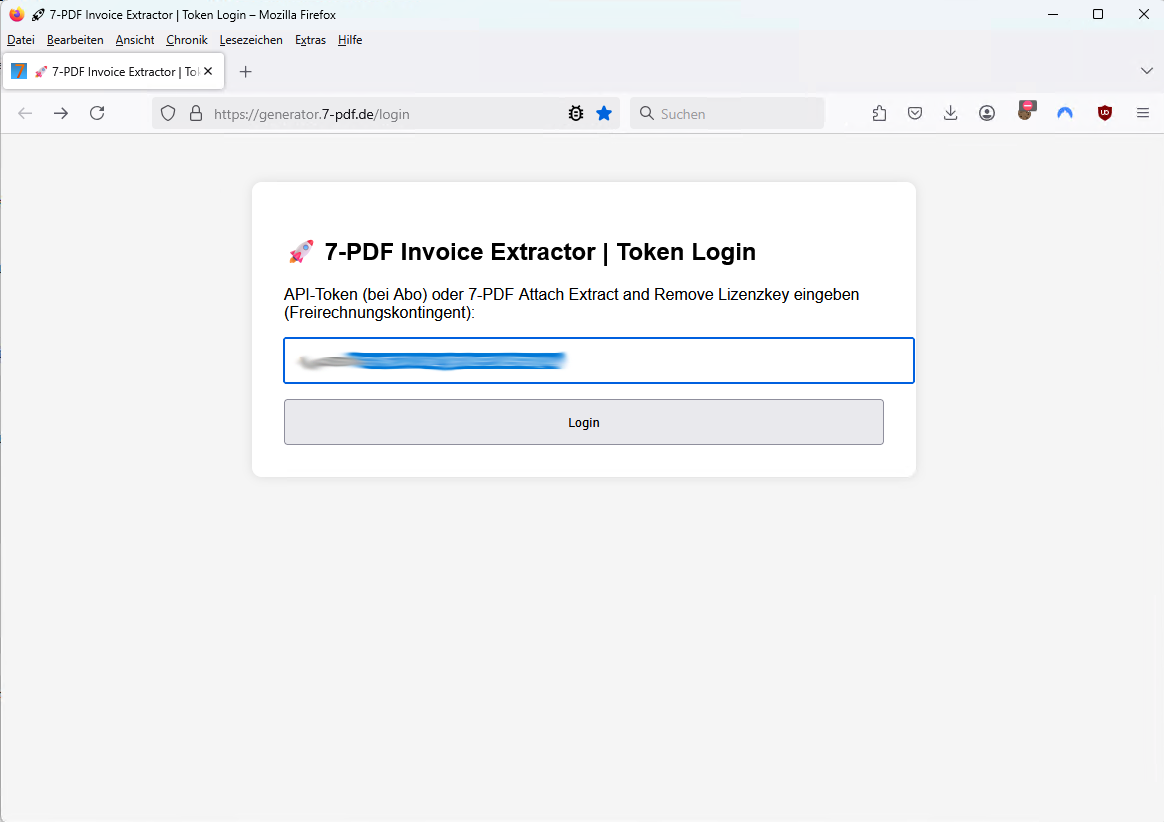

2) No installation: Use our ZUGFeRD Online Portal — here, the API token alone is sufficient.

Tip: For visual & schematic checks, use the 7-PDF E-Invoice Validator. Save 10% on licenses via cart cross-selling.

📢 From now on: Licenses for 7-PDF Attach Extract and Remove + API Token are only available upon request and subject to availability.

Simply print 🖨️ ZUGFeRD e-invoice – from 📝 Word, 📊 Excel or any system!

Still creating invoices with Word or Excel? No problem! Our new 7-PDF Invoice Extractor lets you convert your PDF invoices – generated from Word, Excel, or even legacy ERP systems – into a fully valid ZUGFeRD PDF e-invoice within seconds, without requiring any new ERP infrastructure or software migration.

Thanks to intelligent AI-powered analysis, the 7-PDF Invoice Extractor automatically detects all relevant invoice data – from issuer to line items, tax rates, and gross totals. Once the text flow is machine-readable and your invoice data is formally correct according to DIN EN 16931, a compliant PDF/A-3 with embedded XML file in accordance with DIN EN 16931 is generated at the push of a button.

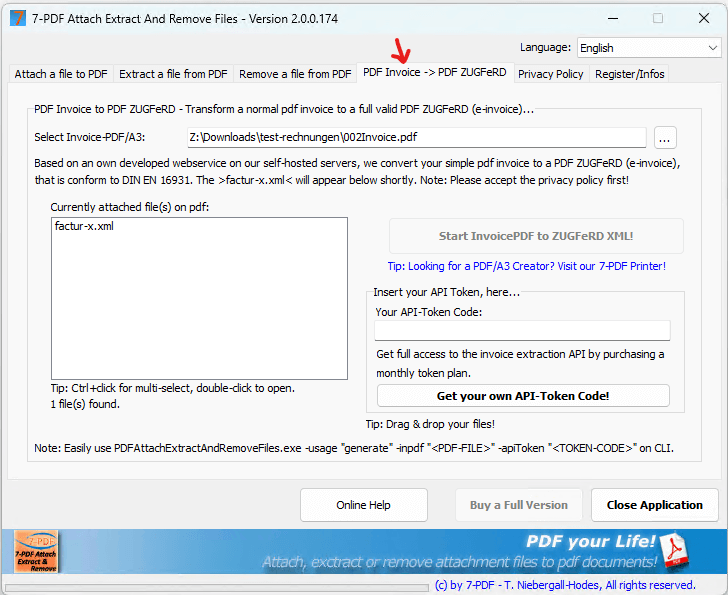

💡 If you do not need a printing workflow (PDF invoice is available), you can also use 7-PDF Attach Extract and Remove directly to convert your PDF invoices into ZUGFeRD-compliant e-invoices. Alternatively, you can do this completely without installing any software using our online portal at https://konverter.zugferd-rechnungen.de/en/.

✔ Printing workflow: What is required?

- Download: 📥 7-PDF Printer Professional (To generate PDF/A-3b format)

- Download: 📥 7-PDF Attach Extract and Remove (Generate/Attach AI ZUGFeRD XML)

- Optional download: 📥 7-PDF E-Invoice Validator (Validate the ZUGFeRD PDF)

- Alternatively, simply use our 🌐 online portal https://konverter.zugferd-rechnungen.de

Please do not reprint existing PDF invoices from a PDF viewer into the print workflow shown here. This can destroy the text structure (rasterization/binarization) and degrade recognition. Instead, convert such files directly with 7-PDF Attach Extract and Remove into a ZUGFeRD-compliant e-invoice.

💡 IMPORTANT: For unambiguous detection of the document type in the e-invoice, the exact term "Invoice" (or "Final invoice" or "Credit note") — ideally at the beginning of the document — must be clearly and visibly present in the invoice data. Labels such as "fee statement", "cost note", or similar are not considered GoBD-compliant invoices and will not be processed as such.

🚀 Here’s how it works:

Follow this transparent step-by-step guide – you’ll be ready in 10 easy steps!

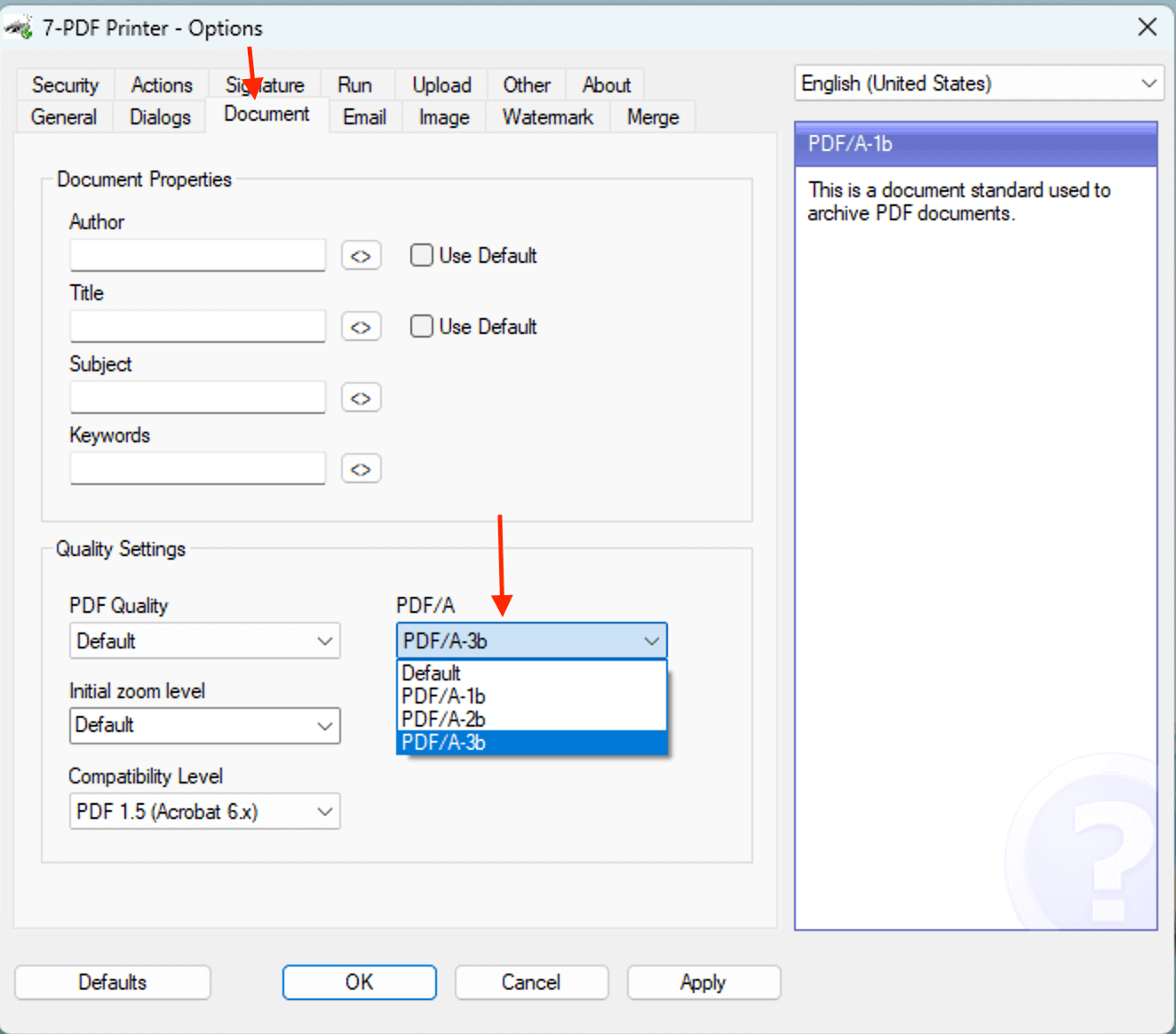

- First, install the 📥 7-PDF Printer Professional Edition on your system. We need the PDF/A-3b format for legally compliant ZUGFeRD documents. This format is supported in the Professional edition of 7-PDF Printer. You’ll find an installation video on this page.

- If not already done, install 📥 7-PDF Attach Extract and Remove. You need version 2.0 or newer. We need this tool to embed the ZUGFeRD XML, and our AI-supported analysis service is fully integrated into this software. Download the installer here.

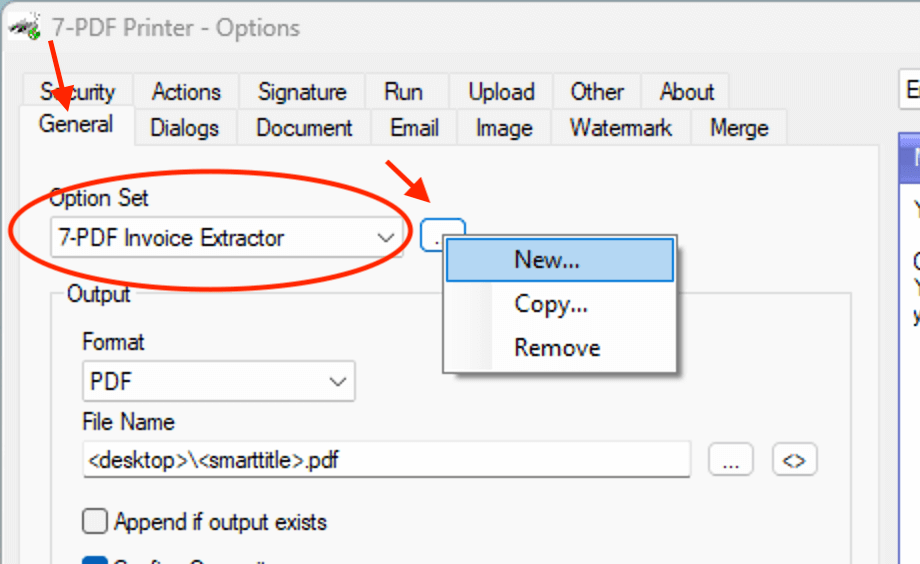

- Next, open the options dialog of 7-PDF Printer.

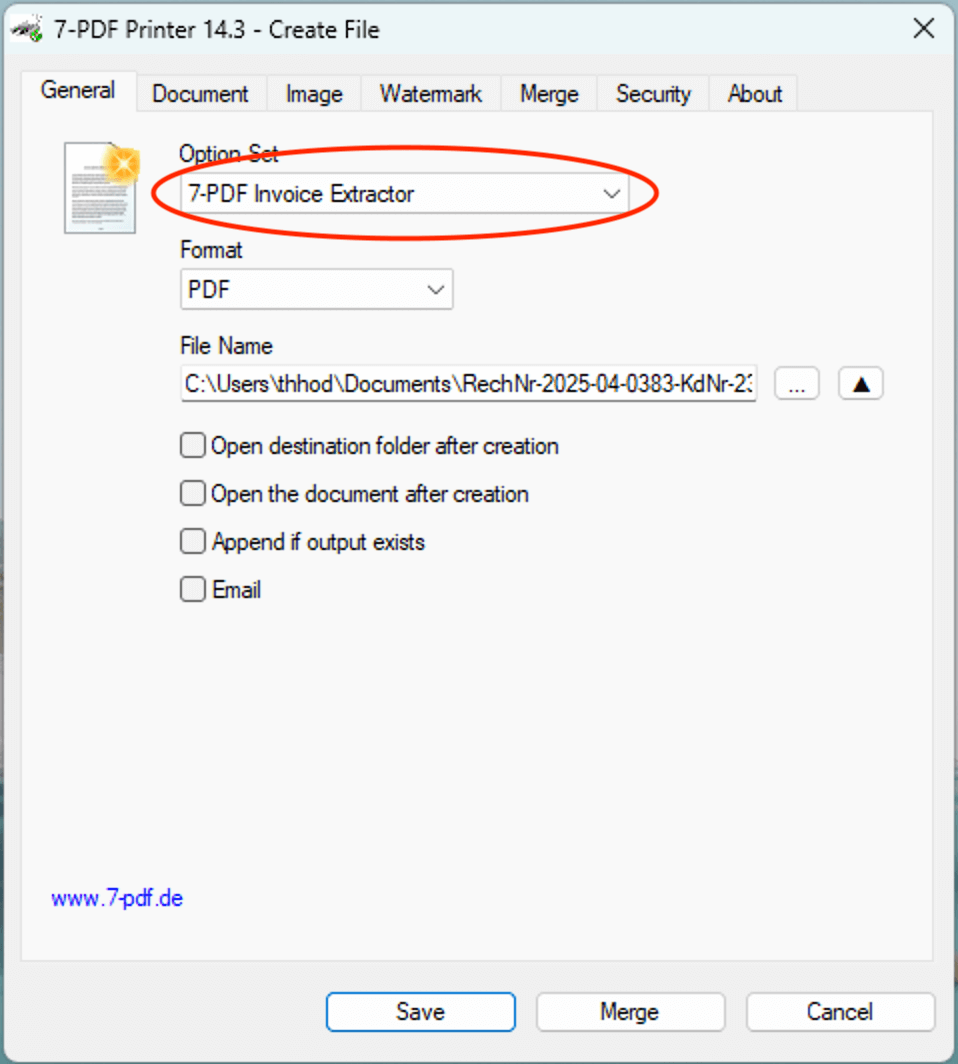

- Create an option set called "7-PDF Invoice Extractor" directly. This is essentially just a configuration name that you select later in the print dialog, which automatically loads all the settings we'll define now. 👉 You only need to create the option set for yourself as a user. Please do not select "...share with other users," which would be WRONG.

- Important: We need to set PDF/A-3 as the preferred output format. This is legally required to produce ZUGFeRD e-invoices that meet long-term archiving regulations. You’ll find this under the “Document” tab.

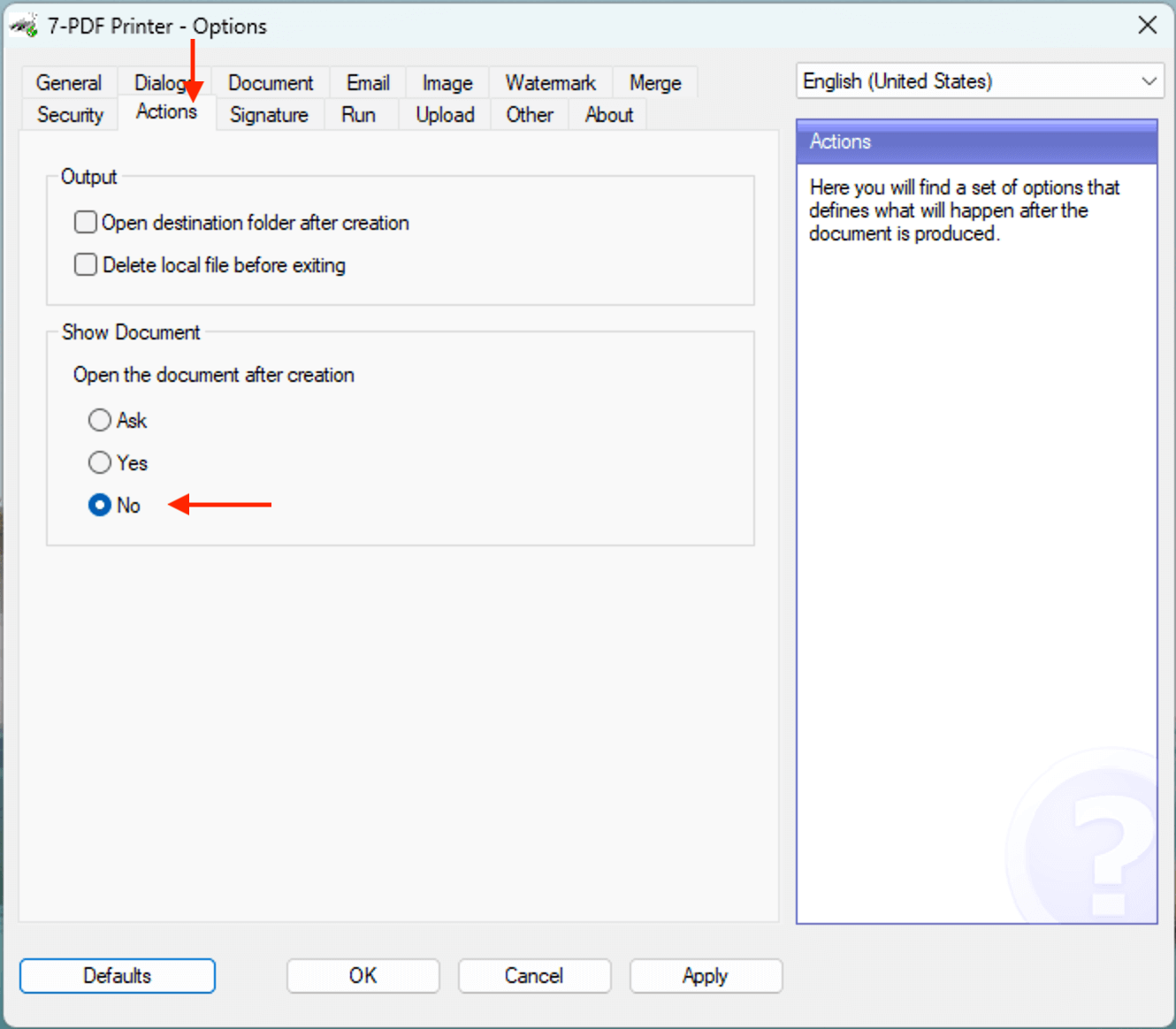

- Next, disable automatic PDF opening after printing. Otherwise, the generated PDF might still be open when the extractor tries to access it. This setting is located under the “Actions” tab.

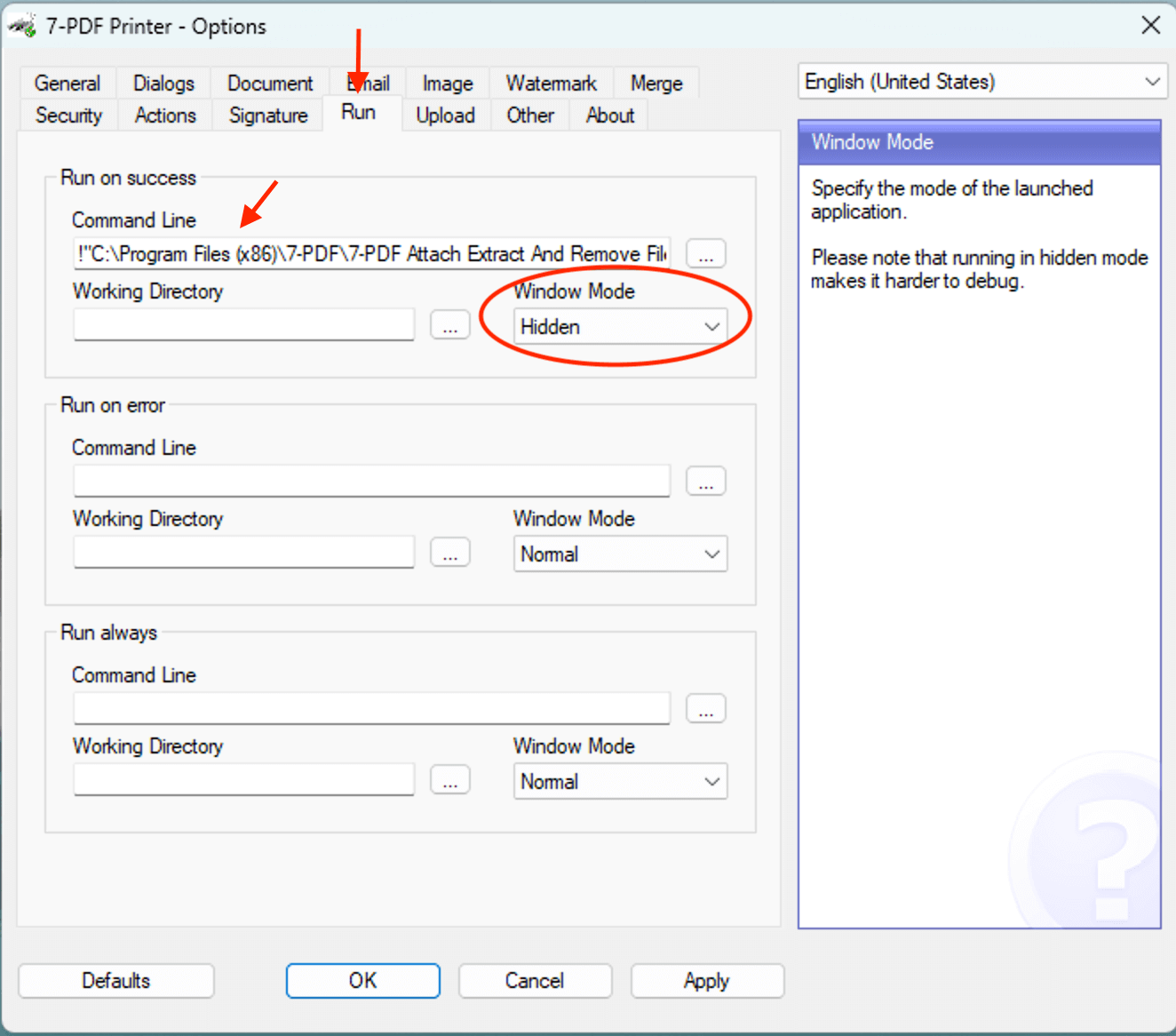

- Now comes the key part – integrating the 7-PDF Invoice Extractor into the print process. After the PDF/A file is created, we want to automatically trigger the 7-PDF Invoice Extractor to generate the corresponding factur-x.xml file.

- Don’t forget to save your settings by clicking “Apply” and then “OK”.

- Now when you print an invoice via 7-PDF Printer from your ERP, Word, or Excel, the printer dialog appears...

- Last but not least, after clicking the "OK" button in the dialog, the default PDF viewer opens with the just-created ZUGFeRD PDF. This call is executed within the InvoiceExtractor.exe EXE file, and not by 7-PDF Printer itself (we had disabled that).

💡 Tip: Don't want the viewer to open? Use the-noviewerparameter.!"C:\Program Files (x86)\7-PDF\7-PDF Attach Extract And Remove Files\InvoiceExtractor.exe" "%1" "" -noviewer

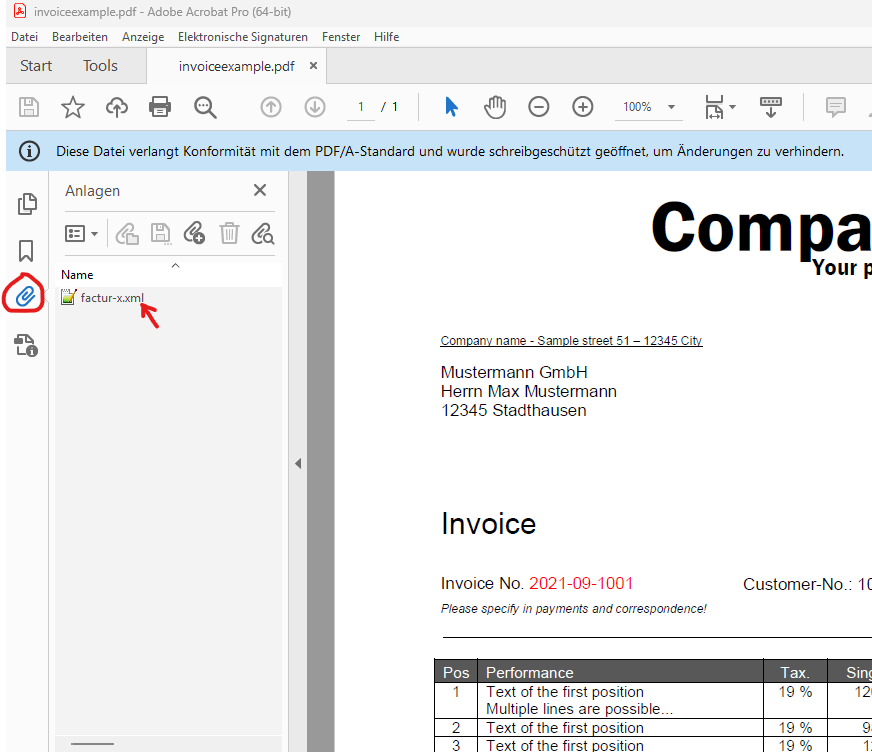

✅ The result

In Acrobat Reader, you'll see the PDF with the embedded

factur-x.xml. Your ZUGFeRD-compliant invoice is ready.

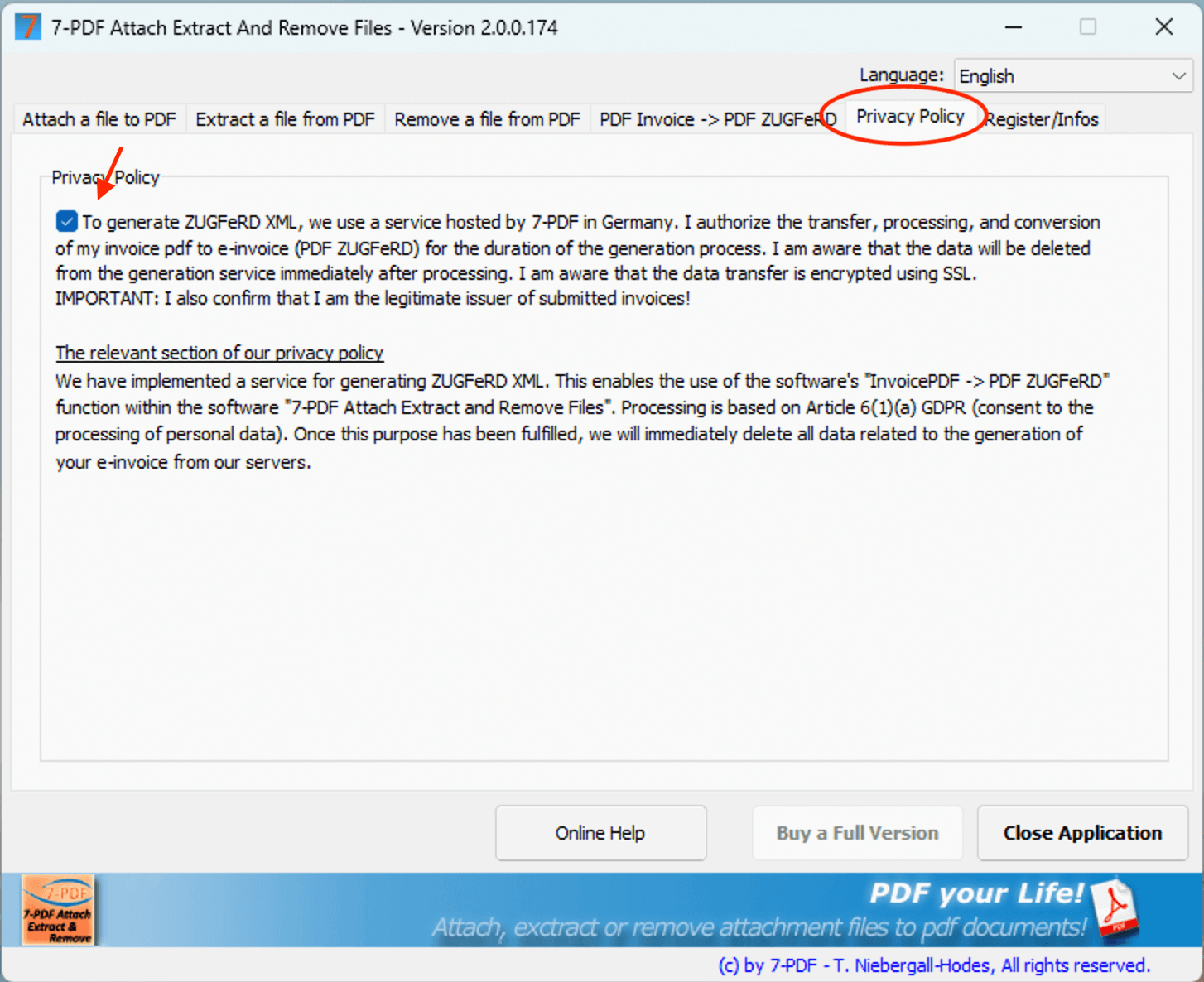

IMPORTANT: Please launch the "7-PDF Attach Extract and Remove" program immediately after installation and switch to the "Privacy" tab. If you wish to use the 7-PDF Invoice Extractor service, you must consent to the transfer and processing of your invoice data; otherwise, the PDF ZUGFeRD creation will fail!

The following screenshot shows the "Privacy" tab with the important check mark!

IMPORTANT: After checking the box, close the program so that the privacy settings are saved!

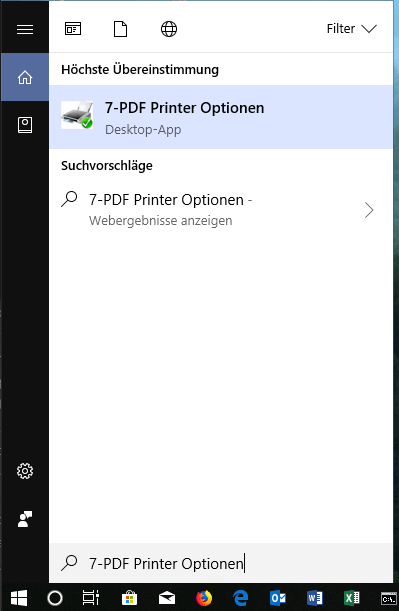

Just type it in via the Windows start menu.

Under the “Execute” tab, set the following command line:

!"C:\Program Files (x86)\7-PDF\7-PDF Attach Extract And Remove Files\InvoiceExtractor.exe" "%1" ""

Explanation: Yes, the command starts with an exclamation mark, and that’s important! The first parameter "%1" is automatically filled with the path to the printed PDF invoice and passed to 7-PDF Attach Extract and Remove.

The empty pair of quotation marks "" must be replaced with your API token, which you receive by purchasing a subscription from us. For now, our free invoice quota is sufficient, so the second parameter remains as it is — empty. The path to the exe file InvoiceExtractor.exe is also enclosed in quotation marks — this is essential due to spaces in the file path. ⚠️ Attention: Don't forget to set window mode to "Hidden"!

Note: This assumes the standard install path has not been changed. Otherwise, please adjust accordingly, or use the “...” button to select InvoiceExtractor.exe. InvoiceExtractor.exe is located in the installation path of the Attach Tool.

Tip: We've created a 📥 Word demo invoice for you. With it, you can immediately try out our 7-PDF Invoice Extractor. Otherwise, feel free to test it with your own invoice template 🙂! The only important thing is that all relevant data — such as your VAT ID, bank details (IBAN, BIC), and the essential invoice information — are present in your template so that 7-PDF Invoice Extractor can do its job.

Choose the “7-PDF Invoice Extractor” OptionSet and a save location. Click “Save”.

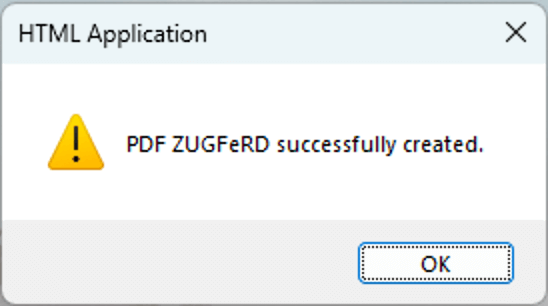

After a few seconds, this message will appear and your just printed PDF file will become a PDF ZUGFeRD e-invoice!

⏳ Note: Depending on the invoice's complexity and length, the conversion to a ZUGFeRD e-invoice may take anywhere from a few seconds to several minutes. A confirmation message will appear automatically once the process is complete. Please be patient!

⛔ Please do not send existing PDF invoices through a PDF viewer such as Acrobat Reader into the print workflow shown here! This can break the text structure (rasterization/binarization) and degrade recognition. Instead, convert such files directly with 7-PDF Attach Extract and Remove into a ZUGFeRD-compliant e-invoice.

In case you do not receive a success message:

👉 Avoid uploading incomplete or unsuitable documents. For initial anonymous and non-binding tests, please use exclusively our free sample invoice.

💡 Only complete and valid invoices can be processed successfully.

If no success message appears, the invoice is usually missing required information (e.g. items, correctly calculated invoice amounts, IBAN, VAT ID, tax number, etc.), or the free quota has already been used up. The "Shit In, Shit Out" (SISO) principle applies here as everywhere in IT! 😊

Tip: For more information on what to consider when creating a PDF invoice document to ensure valid ZUGFeRD output, please visit our

FAQ page for the 7-PDF Invoice Extractor.

In most cases, the cause does not lie with our service but rather with the provided invoice data.

For unlimited access, we recommend purchasing an API token and integrating it into ...InvoiceExtractor.exe" "%1" "XYZ...".

🔍 How do I validate the e-invoice result?

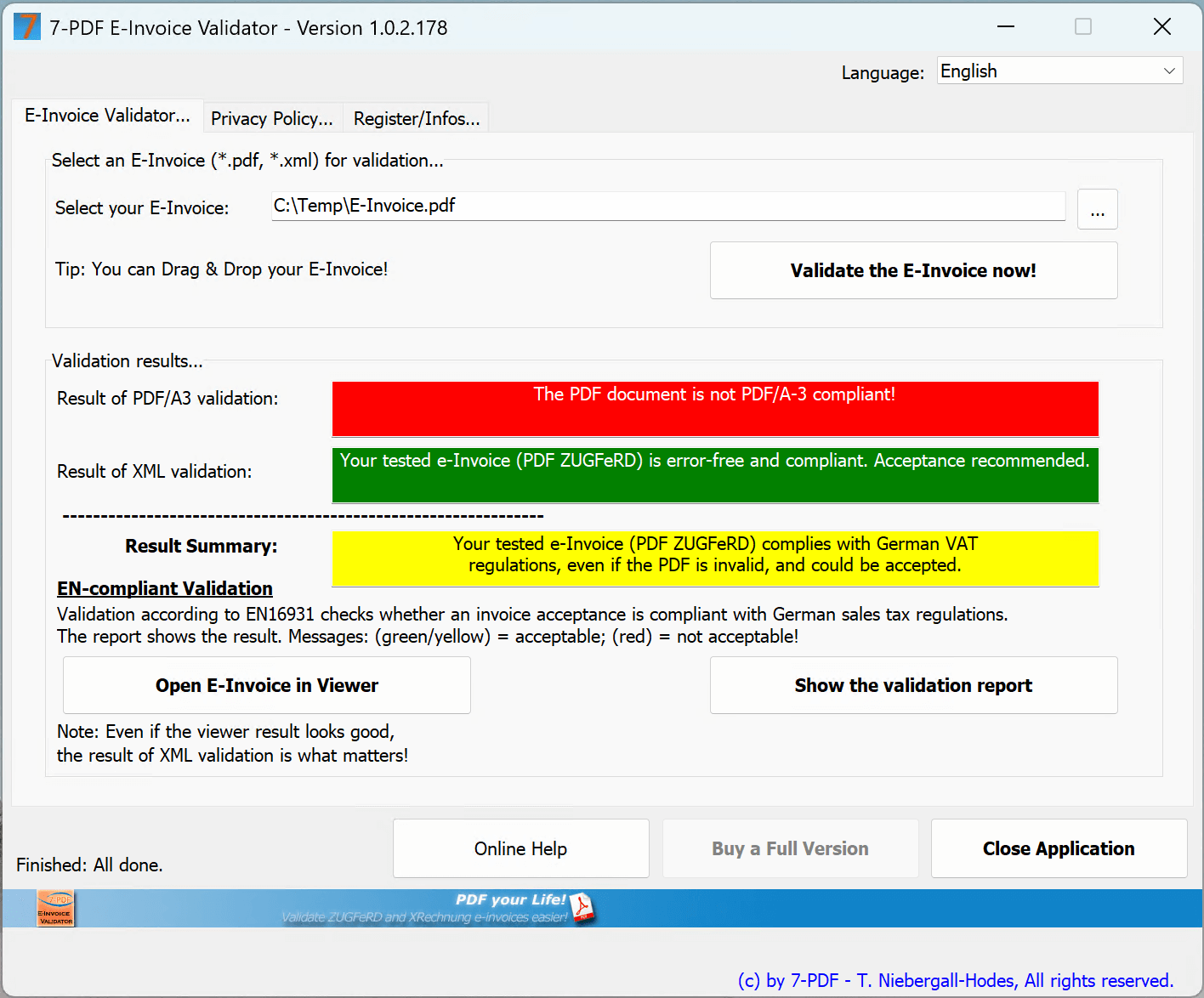

Every invoice created with our 7-PDF Invoice Extractor should be reviewed for content, schema and structure in line with DIN EN 16931 before you share it with third parties. For this, we provide our 7-PDF E-Invoice Validator. With this software you can open a human-readable view of the e-invoice data (E-Invoice Viewer) and generate a validation report indicating whether the produced e-invoice complies with the formal requirements of the e-invoice format.

📌 Quick start

Validating an e-invoice is straightforward:

- Open the 7-PDF E-Invoice Validator.

- Drag & drop an e-invoice (

.pdfor.xml) into the application window. - Alternatively, click the "…" button to choose a file.

- Click "Validate e-invoice now" to start the check.

Note: You may also use any other validator of your choice — the important thing is to validate the e-invoice!

💡 Transparency & Quality: Our PDF Invoice → PDF ZUGFeRD service is ideal for smaller teams with a manual invoicing process and complements existing tools — it does not replace an ERP system. Because AI extraction may vary in individual cases, a professional review of every e-invoice (content & schema) is best practice. Responsibility rests with the invoice issuer.

Automation: Technically possible (e.g., via FastAPI/CLI), but only with mandatory validation chains: XSD/EN 16931 schema validation and content plausibility checks against your data (totals, tax rates, buyer/seller IDs, routing ID/Leitweg-ID, IBAN/BIC, order/reference numbers). Without these controls, we advise against fully automatic dispatch. The AI service can make mistakes; no liability is assumed for the generated ZUGFeRD XML.

🎯 Conclusion: Create your invoice as usual, save it as PDF – and convert it into a proper e-invoice with just one click!

💶 Prices? - Secure our current special offer!

- Full version of 🛒 7-PDF Attach Extract and Remove starting from €41.18 (net) incl. 25 free runs.

- With PDF/A-3 print workflow, use 🛒 7-PDF Printer Professional – starting from €63 (net).

- 💡 Create ZUGFeRD PDFs permanently? Subscriptions from just €3.90/month (net).

- ✅ Smart tip: Get 10% off on additional licenses when buying as a bundle (excl.subscriptions).

🏁 Conclusion: With just a fair €41.18 (net) one-time (Lifetime License) + €3.90/month, you’re ready to enter the world of electronic invoicing – without the need for a PDF/A print workflow.

🎁 Test the solution with up to 10 free invoice runs – 👉 more information below!

💡 ZUGFeRD XML – Best Practices for Robust Validity

Please ensure that your invoice data and price calculations are correct (negative invoice amounts (!) are not permitted according to DIN EN 16931) and that your invoice templates (e.g., from Word or Excel) include IBAN, BIC, and your VAT ID or W-ID number in the format DE123456789 (no spaces). In exceptional cases, it is permissible to use your tax number (in accordance with the small business regulation). However, this requires that the VAT ID of the buyer is stated on the invoice, as required by ZUGFeRD. These details are required for valid ZUGFeRD XML and for VAT deduction eligibility. All datas will be subjected to a plausibility check and only transfered back if the check is successful. Otherwise, you will receive an error message instead of valid XML. If you do not yet have a VAT ID/W-IdNr., please contact your local tax office.

Note: Please ensure that tax-exempt invoices – for example, within the scope of intra-community trade in the EU – contain a corresponding note on the invoice that includes terms such as non taxable or preferably Reverse Charge. This is the only way the required reason for tax exemption can be correctly specified in the ZUGFeRD XML.

Important: Avoid placing this information only as graphics in the header or footer of your template! Our OCR may not reliably detect such information — especially if the image quality of the submitted PDF is suboptimal. Please ensure that these values appear as machine-readable text within the invoice document itself.

✅ Check your outgoing e-invoices visually and structurally for errors using our 7-PDF E-Invoice Validator, or integrate validation directly into your print process.

🚨 Privacy & Security Notice

- 🔒 All data is transmitted encrypted (SSL)

- ❌ No storage: Invoice data is immediately deleted after processing

- 🇩🇪 Infrastructure and AI services run on servers located in Germany

- 🏢 As a German sole proprietorship, we personally stand for quality, data protection, and reliability.

🎁 Free gift: 10 invoice conversions – Get started easily!

✅ With the free trial version of 7-PDF Attach Extract and Remove, you’ll receive up to 10 free invoice runs to convert standard PDFs into fully compliant ZUGFeRD PDF/A-3 e-invoices – no license required.

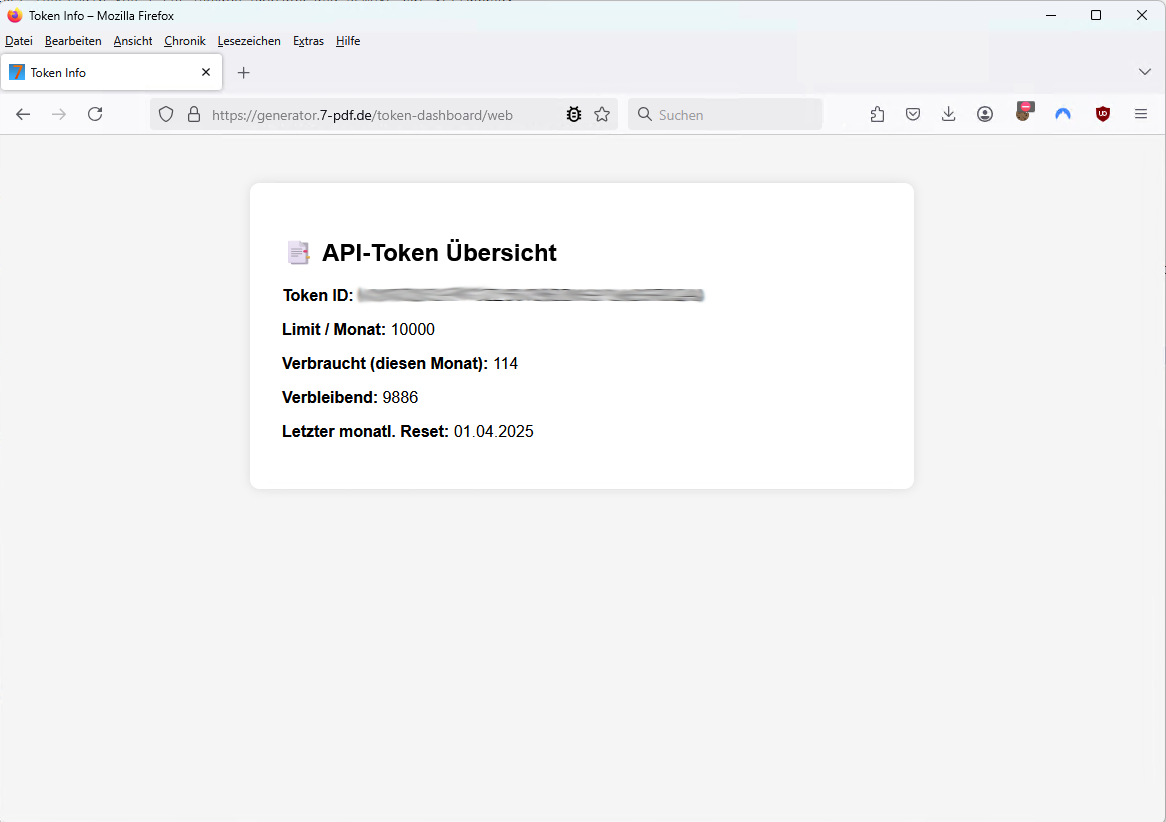

🔄 Once your free quota has been used up and after licensing the program 7-PDF Attach Extract and Remove, you have the option to 💳 purchase an API token (subscription) for a defined quota of invoice runs – flexible, transparent, cancellable annually or monthly.

🖨️ Tip: Create PDF/A-3 files with 7-PDF Printer Professional

To create a fully ZUGFeRD-compliant e-invoice, your original PDF must be in PDF/A-3b format. Use our recommended solution 7-PDF Printer Professional to convert your invoice by simply printing it to PDF/A.

💡 When purchasing 7-PDF Attach Extract and Remove, you’ll get 7-PDF Printer Professional at an automatic 10% discount via cross-selling – the perfect combo for full ZUGFeRD invoice generation!

🛒 Tip: Watch for this symbol 👆 in the cart – click it to reveal your discounted cross-selling offers!

📘 Note on Special Tax Rules (Germany only)

The 7-PDF Invoice Extractor automatically supports the reverse charge procedure for intra-community B2B invoices in accordance with § 13b of the German VAT Act (UStG) (e.g. for EU customers with a valid VAT ID).

Invoices with national reverse-charge exceptions (e.g. construction services or metal trading according to § 13b German VAT Act (UStG) Annex 4 UStG) as well as invoices under the small business regulation pursuant to § 19 UStG are also supported!

Important: This functionality is tailored to the legal framework in Germany. If you are subject to different national VAT rules outside Germany, please consult your tax advisor and ensure local compliance when using the tool.

🔌 Use CLI and FastAPI Integration

If you want to integrate the 7-PDF Invoice Extractor's FastAPI into your own applications, visit the Documentation page for detailed technical information.